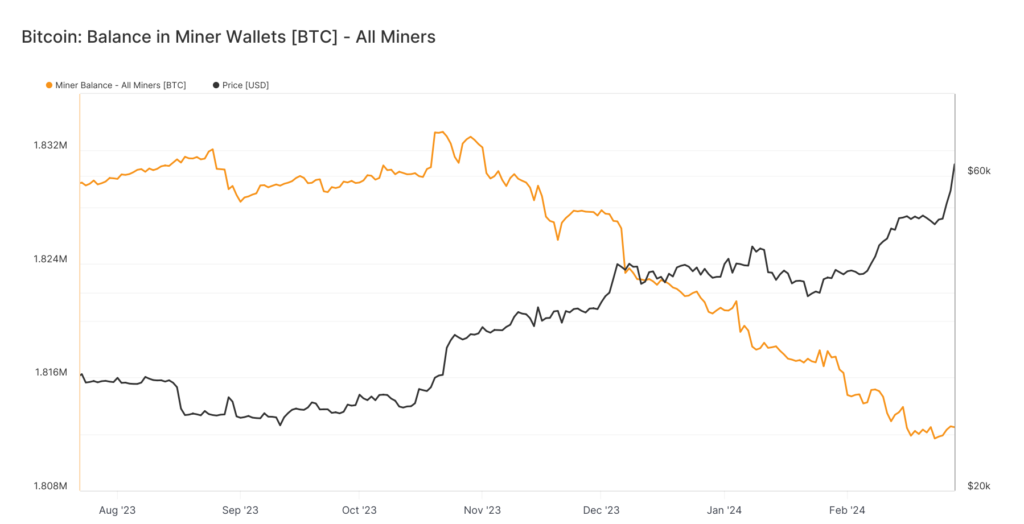

The quantity of bitcoin held in wallets associated with miners has reached its lowest point since mid-2021.

• The amount of BTC held in wallets connected to cryptocurrency miners has decreased by 8,426 this year, continuing the downward trend that began in October.

• The forthcoming reward halving and the dry season in China could be reasons why miners are depleting their coin reserves.

The volume of bitcoin (BTC) held by crypto miners has fallen to its lowest level since July 2021 as they use up their coin reserves in anticipation of the scheduled halving of block rewards.

According to data from Glassnode, the estimated quantity of BTC held in wallets linked to miners has dropped by 8,426 BTC ($530 million) since the beginning of the year, now standing at 1,812,482 BTC. This decline started in the latter half of October when miners possessed over 1.83 million BTC.

Miners validate blocks by adding transaction records to the public ledger, or blockchain. They are rewarded with newly generated coins for this task, in addition to transaction fees.

Currently, miners receive 6.25 BTC per block. The upcoming halving, set for April, will cut this figure in half to 3.125 BTC, reducing per-block revenue by 50%. FRNT Financial, a crypto platform based in Toronto, suggests that miners might be utilizing their stored BTC to invest in more efficient equipment in order to lower operating costs.

FRNT Financial stated in a Tuesday newsletter, “Miners may also be inclined to sell in order to better position themselves ahead of the halving. This may involve purchasing more efficient mining equipment due to the new economics the halving will bring.”

The halving is widely regarded as a significant challenge for miners, as it is expected to decrease revenues while simultaneously increasing production costs. This could lead to industry consolidation.

Another factor contributing to the decline in miners’ bitcoin holdings could be the prolonged dry season in southwest China, typically lasting from October to March/April. China represents around 20% of the total computing power on the Bitcoin network.

“Miners in some Chinese regions are known to bring additional hardware online during the wet season when hydro power becomes abundant. Conceivably, miners may sell during the dry season to counteract the inactivity of mining hardware,” FRNT Financial explained.